Bitcoin Futures

The SUBFROST APP is currently in development and its interface is subject to change.

The Futures market lets you trade ftrBTC—time-locked Bitcoin positions with deterministic pricing. Hold to expiry for full redemption, or exercise early with a small premium.

Highlights:

- Choose lock periods from 1-95 blocks

- Premium decreases as expiry approaches

- Built-in profit calculator

- Position tracking and exercise controls

What is ftrBTC?

ftrBTC (Future Bitcoin) is a time-locked position where:

- You choose a lock period between 1 and 95 blocks

- At expiry: 1 ftrBTC = 1 BTC (full redemption)

- Early exercise: Pay a small premium that decreases as expiry approaches

These futures are created from mining pools who want to hedge against the block-maturity rule. Mining pools can access their BTC (via frBTC) immediately rather than waiting 100 blocks for their mining rewards to unlock. This creates a high-potential futures market for speculative traders.

How Pricing Works

The Premium

When you exercise ftrBTC before expiry, you pay a small premium. This premium:

- Is highest when the contract is new

- Decreases steadily as expiry approaches

- Reaches nearly zero at expiry

| Time to Expiry | Approximate Premium |

|---|---|

| Just created | ~5% |

| Halfway | ~2-3% |

| Near expiry | ~0.1% |

| At expiry | ~0% |

Market Price vs Exercise Price

- Market Price: What you pay to buy ftrBTC from other traders

- Exercise Price: What you receive when you redeem (deterministic based on time remaining)

Buy when the market price is below what the exercise price will be at your intended hold time, then hold until that point.

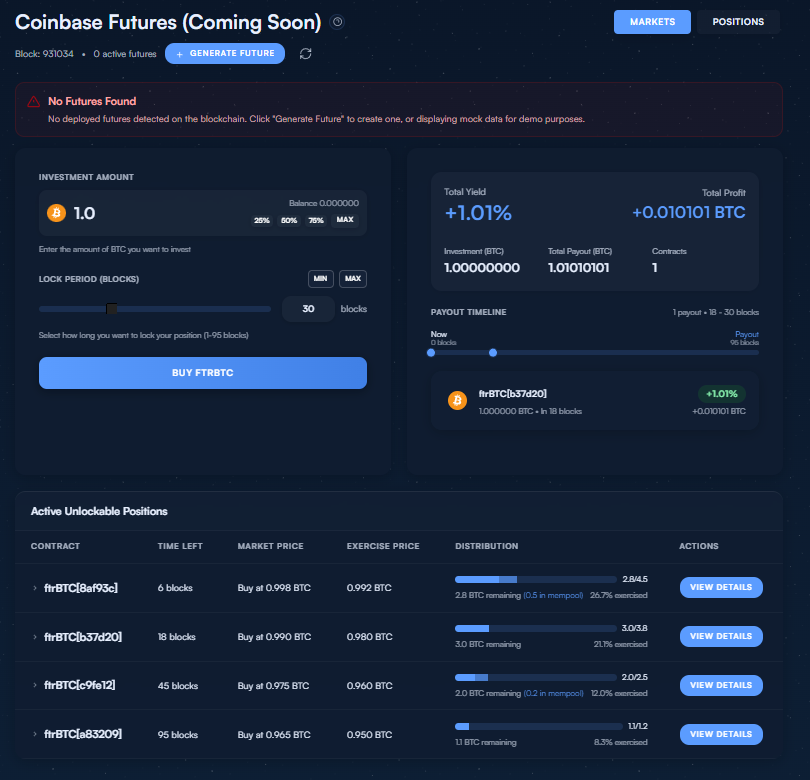

Markets View

The Markets tab displays active unlockable positions:

Each contract shows:

- Contract — Unique contract identifier

- Time Left — Blocks until expiry

- Market Price — Current buy price

- Exercise Price — Current redemption value

- Distribution — How much is remaining vs exercised

Click "View Details" on any contract to see more information.

Opening a Position

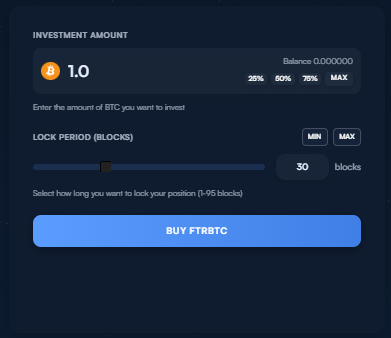

Step 1: Enter Investment Amount

Specify how much BTC you want to invest.

Use quick-select buttons: 25% / 50% / 75% / Max

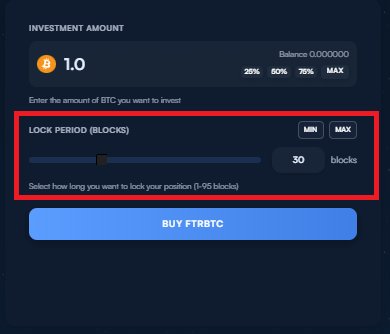

Step 2: Set Lock Period

Choose your lock period in blocks (1-95). Longer lock periods mean lower premiums.

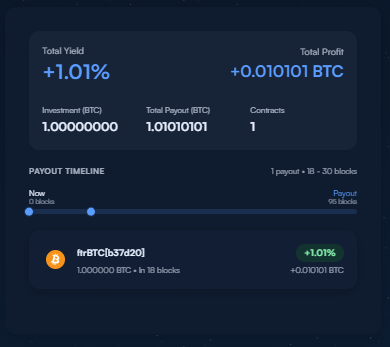

Step 3: Review the Calculator

The interface automatically shows:

- Total Yield — Expected percentage return

- Total Profit — Profit in BTC

- Investment (BTC) — Amount you're investing

- Total Payout (BTC) — What you'll receive at expiry

- Payout Timeline — Visual timeline showing when you'll receive funds

Step 4: Confirm Purchase

Click "Buy ftrBTC" and sign the transaction. Your position appears in the Positions tab.

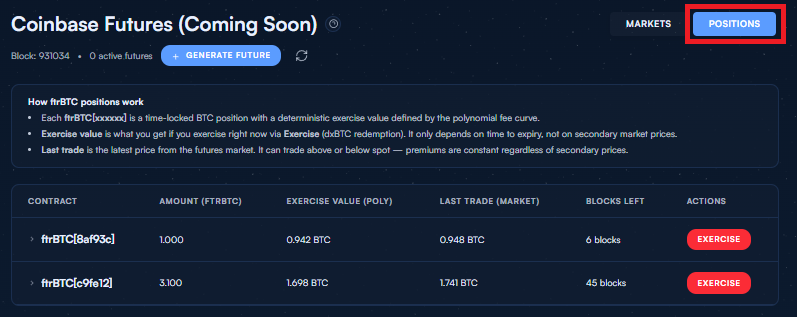

Managing Positions

Switch to the Positions tab to view your holdings:

For each position you can see:

- Contract — Which ftrBTC contract

- Amount (ftrBTC) — How much you hold

- Exercise Value — What you'd receive if exercising now

- Last Trade (Market) — Most recent market price

- Blocks Left — Until contract expiry

Exercising a Position

Click Exercise to redeem your ftrBTC for BTC. The exercise value moves deterministically as blocks pass—holding to expiry removes the time penalty (0% fee).

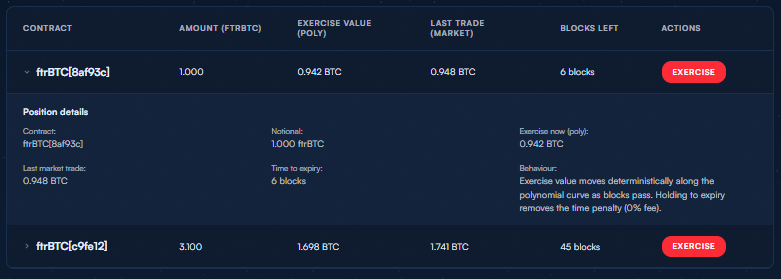

Contract Details

Expand any position to see detailed information:

- Contract — Contract identifier

- Notional — Amount in ftrBTC

- Time to expiry — Blocks remaining

- Exercise now — Current redemption value

- Last market trade — Most recent trade price

- Behaviour — How the exercise value changes over time

Strategies

Hold to Expiry

The simplest strategy—buy ftrBTC at a discount and hold until expiry for 1:1 redemption.

Active Trading

Monitor market prices for contracts trading below their fair value. Buy undervalued contracts and either hold or sell when the price rises.

For Miners

Futures can help smooth out mining revenue by locking in future value.

Risk Considerations

Like all futures instruments, trading comes at a risk:

- Market prices can move against you

- Early exercise costs a premium

- Never invest more than you can afford to hold until expiry

Tips

- Check multiple contracts — Different contracts have different expiry times

- Use the calculator — Let the interface show you expected returns

- Don't wait until the last moment — Leave time for your transaction to confirm

- Start small — Understand the mechanics before committing large amounts