dxBTC Overview

Yield-bearing BTC of Bitcoin L1

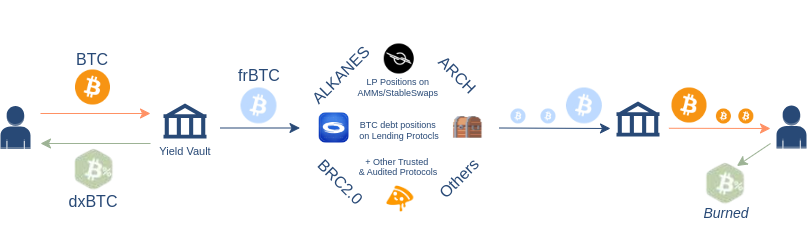

dxBTC is a yield-generating synthetic Bitcoin asset built on top of the SUBFROST ecosystem. It is designed to provide Bitcoin holders with a way to earn a sustainable yield on their assets in a trust-minimized and decentralized manner.

In practice, this is the simplest possible way for a user to earn BTC yield with their BTC:

- User signs a single Bitcoin transaction to stake their native BTC in the SUBFROST yield vault. The user receives

dxBTC, which represents their staked BTC. - Their BTC is wrapped to

frBTCand deployed into market-neutral LP strategies and over-collateralized lending protocols across Bitcoin L1, earning yield regardless of BTC price movement. - This yield is then passed back to stakers in the form of native BTC, which the user can check at any time.

- User signs a single Bitcoin transaction to unstake their native BTC and burn their

dxBTC.

These yield vaults will be deployed across Alkanes, Arch, BRC 2.0, and any other programmable ecosystem that launches on Bitcoin mainnet.

This economic model is already proven on other blockchains like Ethereum and Solana and can be dramatically simplified for the end user.

How does it work? frBTC + Yield

At its core, dxBTC is an alkane that locks up frBTC. SUBFROST governance then acts as a decentralized strategist, deploying the locked frBTC into various conservative yield-generating strategies.

These strategies can include:

- Providing liquidity to decentralized exchanges: The

frBTCcan be used to provide liquidity to delta-neutral LPs likefrBTC/wBTCor other trading pairs on decentralized exchanges, earning trading fees. - Lending: The

frBTCcan be lent out on decentralized, over-collateralized lending platforms to earn interest. - Cross-chain Strategies: The

frBTCcan be trustlessly bridged to other blockchain ecosystems, like Hyperliquid, to participate in yield farming opportunities.

The profits generated from these strategies are then distributed back to the dxBTC holders, allowing them to earn a passive income while maintaining full exposure to their BTC. This provides a way for Bitcoin holders to put their assets to work without having to sell them or trust a centralized custodian.

The Role of SUBFROST Governance

SUBFROST governance plays a crucial role in dxBTC. The governance is responsible for:

- Selecting and managing yield-generating strategies: The governance researches, vets, and selects the most promising and secure yield-generating strategies for the locked

frBTC. - Monitoring and rebalancing: The governance continuously monitors the performance of the selected strategies and rebalances the portfolio as needed to optimize yield and manage risk.

- Distributing profits: The governance ensures that the profits generated from the yield-generating strategies are distributed fairly to all

dxBTCholders.

By combining the security and decentralization of SUBFROST with the yield-generating potential of DeFi, dxBTC provides a powerful new tool for Bitcoin holders to grow their wealth.