dxBTC Overview

Bitcoin High Yield Savings

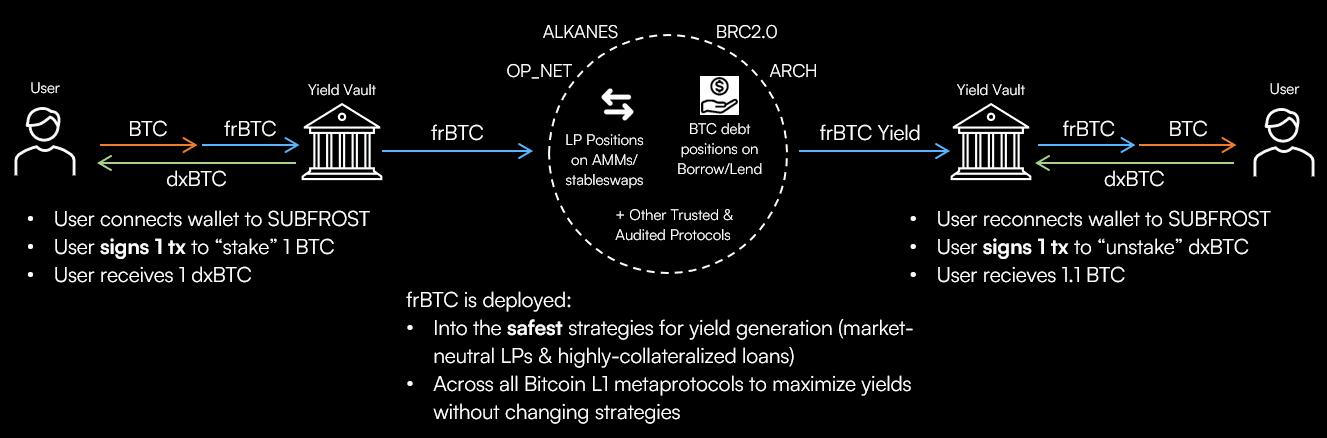

dxBTC is the liquid staking, yield-bearing synthetic asset of Bitcoin Layer-1:

- User signs a single Bitcoin transaction to stake their native BTC in the SUBFROST yield vault. The user receives

dxBTC, which represents their staked BTC. - Their BTC is wrapped to

frBTCand deployed into market-neutral LP strategies and over-collateralized lending protocols across Bitcoin L1, earning yield regardless of BTC price movement. - This yield is then passed back to stakers in the form of native BTC, which the user can check at any time.

- User signs a single Bitcoin transaction to unstake their native BTC and burn their

dxBTC.

These yield vaults will be deployed across Alkanes, BRC 2.0, OP_NET, Arch, and any other programmable ecosystem that launches on Bitcoin mainnet.

These yield vaults will be deployed across Alkanes, BRC 2.0, OP_NET, Arch, and any other programmable ecosystem that launches on Bitcoin mainnet.

This economic model is already proven on other blockchains like Ethereum and Solana and can be dramatically simplified for the end user.

Tokenomics: The exact amount of circulating dxBTC will be the exact amount of BTC deployed to SUBFROST's yield vault.